Exhibit 99.1

UNITED

STATES DISTRICT COURT

NORTHERN DISTRICT OF ILLINOIS

EASTERN DIVISION

|

Datavault AI, INC. and Nathaniel T. Bradley,

Plaintiffs,

-against-

Wolfpack Research LLC and Dan David,

Defendants.

|

Case No.:

JURY TRIAL DEMANDED |

COMPLAINT

Plaintiffs Datavault AI, Inc. (“Datavault”) and Nathaniel Bradley, (collectively, “Plaintiffs”), by and through their attorneys, Paul Hastings LLP, as and for its complaint against Wolfpack Research LLC (“Wolfpack Research”) and Dan David (collectively, “Defendants”), hereby state as follows:

PRELIMINARY STATEMENT

1. Plaintiffs bring this action to redress a deliberate, malicious, and defamatory “short-and-distort” campaign carried out by defendant Dan David, a self-styled “activist short seller,”1 against Datavault and certain of its executives and employees. Operating through Wolfpack Research—a purported “global financial research and due diligence firm”2 that functions as David’s alter ego—David has made a business of borrowing a company’s securities, selling those securities short, and then publishing sensationalized and defamatory “reports” about the company in order to artificially depress the stock price so that David can repurchase and return the stock at the depressed price and profit off of the difference.

1 See Wolfpack Research “About Us” available at https://www.wolfpackresearch.com/about-3, last visited November 4, 2025.

2 Id.

1

2. Holding itself out as a firm “dedicated to protecting investors by ensuring the natural balance of the financial ecosystem3” and “work[ing] tirelessly to uncover differentiated information on individual companies that investors can use to generate alpha,” Wolfpack Research represents to its readers that “all information is accurate and reliable, and has been obtained from public sources that we believe to be accurate and reliable.” See Report at p. 15. In reality, the fine-print legal disclaimer that Wolfpack Research includes at the very bottom of its “reports” tells the true story: “You are reading a short-biased opinion piece. Obviously, we will make money if the price of the covered issuer stock declines. As of the time and date of each report, Wolfpack is short the securities of, or derivatives linked to, the securities of the subject issuer.” See Exhibit A at p. 15 (emphasis added).

3. Defendants’ entire business model depends on misleading the market. By publishing reports with false and hyperbolic allegations that appear credible to the unsuspecting public, Defendants trigger abrupt, artificial sell-offs from concerned investors, and then profit once the stock price tanks. Put simply, David and Wolfpack Research inflict severe intentional reputational and financial damage on their targets, and profit off of that harm before the truth can catch up.

4. Plaintiff Datavault is a dynamic and fast-growing artificial intelligence company, publicly traded under the ticker DVLT. Datavault specializes in visualization, valuation, and monetization of assets in the Web 3.0 environment. On October 31, 2025, Datavault became Defendants’ latest victim. Under the guise of independent research and “due diligence,” Defendants released a “report”4 about Datavault, Bradley, and other associated individuals that is riddled with outright falsehoods, inflammatory accusations and cherry-picked half-truths (the “Report”).

3 See Wolfpack Research “About Us” available at https://www.wolfpackresearch.com/about-3, last visited November 4, 2025.

4 See “DVLT: A Joke Brought To You By A Promoter Sanctioned By The SEC Who Has Co-Authored Patents With A Convicted Felon Charged In An Elaborate Pump-And-Dump,” Wolfpack Research, dated October 31, 2025, (the “Report”) attached hereto as Exhibit A.

2

5. The Report contained over 12 full pages of accusations and inflammatory statements about Datavault and its personnel, including claims that Datavault is a sham because it operates from a “beauty salon” and co-working space, that “[i]t takes almost no effort to discover that DVLT’s ‘blockchain’ powered platform, Data Vault, is a joke” and that “[t]rading activity on the platform appears to be minimal, if not non-existent.” See Report at 1. In reality, Defendants picked apart a Google Image result of the location of Datavault’s executive mailing address and registered agent, and relied on sample data intentionally uploaded by one of Datavault’s clients as a public demo to purposefully and maliciously distort the truth that Datavault is a real company with real technology and momentum with robust trading activity on its platform.

6. Misrepresenting fiction as fact so that they could capitalize on the falsehoods before the truth could catch up, Defendants also reported that “[Wolfpack’s] [i]nvestigation [r]eveals DVLT’s [p]latform, Data Vault, [w]hich [i]s [s]upposed to [h]elp [b]usinesses [m]onetize [t]heir [d]ata, [i]s a [w]asteland for NFTs,” see id. at 7, when in reality Data Vault® is a fully operational, enterprise-grade data exchange with blockchain secured, AI-enriched datasets. The Report also claimed that “DVLT Is [m]isleading [i]nvestors by [t]outing [i]ntegration of [i]ts AI [s]olutions into the [s]ystems Of Burke,” despite that there is formal documentation establishing Datavault’s engagement of Burke.

3

7. The disregard for Datavault’s public filings, ignorance of verifiable facts, and omission of critical context did not stop there, the Report also attacked Datavault’s personnel, claiming they are “top-tier bullshitters including a convicted felon,” and that they have “resume[s] that should terrify investors.” See id. at 3. Such reputational attacks are untrue and they spur public distrust when none is warranted. To amplify the false statements in order to further manipulate DVLT’s stock lower, Defendants launched a coordinated social media barrage to maximize market impact, reposting snippets of the report to X and “pinning” the article to the top of Wolfpack’s X account.

8. Exactly as Defendants planned, following publication of the Report and Wolfpack’s posts on X, Datavault’s stock dropped more than 15%. Investors have commented that they were spurred to sell because of the Report and the false statements therein. Wolfpack’s malicious tactics succeeded. Worse still, other media outlets have begun to seize on the allegations, regurgitating them to new readers as fact and worsening the harm to Plaintiffs’ reputation. The damage to Plaintiffs’ reputation, business operations, and market value is not theoretical—it is active, escalating, and measurable. Through this litigation, Plaintiffs seek to correct the record and remedy the substantial harm that Defendants have inflicted.

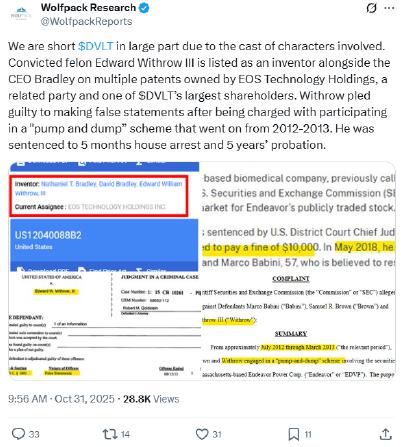

PARTIES

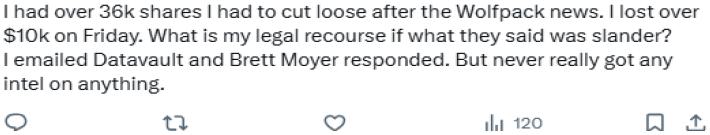

9. Plaintiff Datavault AI, Inc. is incorporated in Delaware, has its corporate headquarters in Philadelphia, Pennsylvania, and maintains principal operations in Lisle, Illinois.

10. Plaintiff Nathanial T. Bradley is the co-founder and CEO of Datavault. He is domiciled in, and therefore a citizen of Pennsylvania for purposes of diversity citizenship.

11. Upon information and belief, Defendant Wolfpack Research LLC have their principal place of business in New York, New York.

4

12. Upon information and belief, Defendant Dan David is domiciled in, and therefore a citizen of, New York for purposes of diversity citizenship.

JURISDICTION AND VENUE

13. This Court has subject-matter jurisdiction over the claims alleged herein pursuant to 28 U.S.C. § 1332 because there is complete diversity between the parties and the amount in controversy exceeds the sum of $75,000, exclusive of interest and costs. Specifically, Datavault has more than one-half of its employees located in Lisle, Illinois, and derives the majority of its revenues from its operations there. As a result, a substantial part of the events giving rise to the claims occurred and a substantial part of the harm was felt, in the Northern District of Illinois. Plaintiff Bradley is domiciled, and therefore a resident of, Pennsylvania for purposes of diversity jurisdiction, while Defendants Dan David and Wolfpack Research are, upon information and belief, New York based.

14. Pursuant to 28 U.S.C. § 1391(b)(2), venue is proper in this District because Plaintiff maintains significant business operations in Lisle, Illinois. As stated above, Datavault has more than one-half of its employees located in Lisle, Illinois, and derives the majority of its revenues from its operations there. As a result, a substantial part of the events giving rise to the claims occurred and a substantial part of the harm was felt, in the Northern District of Illinois.

15. In connection with the conduct alleged in this Complaint, Defendants, directly or indirectly, made contact with Illinois via the use of the means or instrumentalities of interstate communication in connection with the transactions, acts, practices, and courses of business alleged herein.

5

FACTUAL BACKGROUND

16. Datavault is a leading artificial intelligence and data technology company that provides best-in-class data management and monetization solutions. Formerly WISA Technologies, Inc., the Company recently rebranded to reflect its focus on AI-driven data visualization, valuation, and monetization in the Web 3.0 and other next-generation, cloud-based environments. Its platform is built to turn raw data into quantifiable, tradeable assets and revenue streams for its users. Datavault operates through two primary divisions: a Data Science division, which provides cloud-based software and high-performance computing tools for data analytics, tokenization, and monetization, including Datavault’s patented Data Vault® platform, and an Acoustic Science Division, which develops and licenses patented audio and wireless technologies designed to support both traditional media delivery through its patented semiconductor and new forms of software enabled by AI-driven data experiences.

17. Datavault’s patented Data Vault® platform uses blockchain technology, AI, and machine learning to enable secure tokenization of information, protection and tracking of rights and royalties, and the creation of new monetization channels for digital content and other assets.

18. Datavault markets its products and services to customers across a range of sectors, including sports, entertainment, advertising, biotech, biopharma, and other data-intensive industries. Given its portfolio of issued and pending patents, its cloud-based infrastructure, and its branded AI tools (like Data Vault®), the Company is at the forefront of AI-driven data experiences, monetization, and valuation.

19. In recent public filings and press releases, Datavault has touted rapid growth, reporting recognized revenue of approximately $1.7 million in the second quarter of 2025 alone, a nearly 500% year-over-year increase from 2024. Datavault raised aggregate gross proceeds of $160 million from September -November 2025 to support its operations.

6

20. In addition to its core platform capabilities, Datavault AI has secured a series of strategic partnerships designed to accelerate growth and broaden its footprint. For example, Datavault has announced a multi-year IP and commercial alliance with NYIAX, a blockchain-based trading exchange built on the Nasdaq financial framework, integrating the Data Vault® platform to enable real-time listing, pricing, and trading of data assets. In addition, Datavault has filed documentation of its engagement in a strategic partnership with Burke Products, U.S.-based certified Tier 1 defense contractor with Department of Defense sole-source eligibility, to subcontract to Datavault existing defense and aerospace contracts and integrate DVLT’s ADIO® acoustic technology into secure communication modules for Burke’s electrical assemblies. Datavault has also entered into a definitive licensing agreement with Nature’s Miracle (NMHI), granting NMHI global rights to Datavault’s patented carbon credit tokenization system in exchange for an upfront licensing fee and a royalty on all gross revenue generated through the technology. Finally, Datavault has granted Scilex Holding Company (SCLX) a worldwide exclusive license to its AI-driven data tokenization technology for the biotech and biopharma sector, covering genomic, diagnostic, and drug data with a potential market opportunity of up to $2 trillion.

21. Collectively, these partnerships position Datavault to monetize across a variety of major platforms and bridge its patented technologies to multiple large-scale markets, poising itself for accelerated revenue growth and recurring royalty streams.

22. As a publicly traded company focused on strategic growth and profitability, Datavault’s reputation, and the reputation of its executives, personnel, and investors, are one of its most valuable assets. Indeed, Datavault’s business model depends heavily on the perceived credibility of the company, its CEO, and its personnel, along with its intellectual property portfolio, its technological capabilities, and the confidence of its investors, partners, and licensees. Because Datavault monetizes a portion of its technology through strategic partnerships, its continued success relies on maintaining the trust of its counterparties.

7

23. Upon information and belief, Defendant Wolfpack Research is an “activist research” firm that was founded by Daniel David in 2019.

24. David is a self-proclaimed “Freedom of Speech activist in the global financial markets” who purports to have exposed “billions of dollars in fraud against investors over the last 12 years.”5

25. On its LinkedIn page, Wolfpack Research holds itself out as a “global financial research & due diligence firm dedicated to exposing corporate fraud and protecting investors by ensuring a balance in the financial ecosystem.” Specifically, “The Pack,” claims to be “[l]ed by [their] Founder, Dan David,” to “work together, look[] ahead, and [do] everything positive to succeed”:

5 See https://dev.wolfpackresearch.com/about-us/, last visited November 4, 2025.

8

26. On LinkedIn, “The Pack” holds itself out to have between 2-10 employees, while simultaneously listing David as its only employee:

27. Similarly, on its website, Wolfpack Research states that it is “comprised of skilled individuals drawn from a broad cross-section of the global communities in which we operate” and describes a “team” with a “variety of backgrounds, talents, perspectives and experiences in the financial world”:

28. Upon information and belief, and despite holding itself out publicly as a “team” or “pack” with multiple associated individuals, Dan David is the sole member and owner of Wolfpack Research, as well as its only employee.

29. In a section of its website titled “Research,” David uses Wolfpack to publish reports that are little more than highly critical, inflammatory hit-pieces, designed to depress the stock prices of companies that David has taken short positions in.

30. In order to download a full copy of one of Wolfpack Research’s reports, Defendants require readers to first “Accept” a multi-page, small-font, click-wrap “financial disclaimer” that states “all information” contained in each report is “accurate and reliable, and has been obtained from public sources that we believe to be accurate and reliable.” See Report at 15-16. In making this statement, and mandating reader acceptance, Defendants knew and intended that readers would rely on the statements set forth in the reports to be accurate and verifiable.

9

31. On October 31, 2025, Wolfpack Research put Datavault in its crosshairs, and published a report titled: DVLT: A Joke Brought To You By A Promoter Sanctioned By The SEC Who Has Co-Authored Patents With A Convicted Felon Charged In An Elaborate Pump-And-Dump (the “Report”). The Report contained the “Financial Disclaimer” described above.

32. On October 31, 2025 at 9:56 am EST, Defendants disseminated additional inflammatory statements about Datavault, along with links to the Report, on social media by posting to and pinning the Report to the top of Wolfpack Research’s account on the website X (formerly known as Twitter) under the handle @WolfpackReports. As of the filing of this Complaint, the post has been viewed by over 28,800 X users:

10

33. Individual shareholders of Datavault have admitted on their X accounts that they sold stock as a result of Defendants’ report, and now regret it, noting “I had over 36k shares I had to cut loose after the Wolfpack news. I lost over $10k on Friday.”:

34. Upon information and belief, in advance of publishing the Report, David (whether acting individually, through Wolfpack Research, or through a separate or affiliated entity) acquired an interest in a financial asset whereby he could obtain a profit in the event that the price of Datavault’s stock was to decrease in price and/or value. Consistent with this belief, and by Wolfpack Research’s own admission, the financial disclaimer included language noting that “[y]ou are reading a short-biased opinion piece. Obviously, we will make money if the price of the covered issuer stock declines.” See Report.

35. Defendants took no steps to confirm the contents or accuracy of the Report with Datavault prior to its publication, and the Report is replete with a number of false, misleading, and inflammatory statements concerning Plaintiffs.

36. First, the Report incorrectly claims that Datavault’s proprietary technology and patented Data Vault® platform is an operational “wasteland.” Specifically, Wolfpack Research claimed that its “[i]nvestigation [r]eveals DVLT’s [p]latform, Data Vault, [w]hich [i]s [s]upposed to [h]elp [b]usinesses [m]onetize [t]heir [d]ata, [i]s a [w]asteland for NFT’s.” To the contrary, Data Vault® is a fully operational, enterprise-grade data exchange with blockchain-secured, AI-enriched datasets used by governments, corporations, and institutions. The platform has processed thousands of tokenized assets, including carbon credits, voter records, parking logistics, and healthcare compliance datasets. Over 100 active datasets are currently live on the platform, with real transactional volume in carbon offsets, digital twins, and tokenized real-world assets. The “sample” weather data Wolfpack purportedly came across during its “investigation” was intentionally uploaded as a public demo by a client—not an employee—and is not representative of Data Vault’s® commercial listings—information Datavault would have happily explained to Defendants had they bothered to verify their allegations with the Company.

11

37. Second, the Report falsely states that Datavault made “grossly misleading” and “false claims” about its Center for AI & Quantum Computing Excellence in Sandy Springs, Georgia (the “Center”). The Report said “[w]hen you read DVLT’s press release [about the opening of the Center], it sounds to us like they own or lease the building, or at least a few floors, but we went and visited and that is not true.” See Report at 6. But nothing in Datavault’s October 2025 press release would lead a reasonable reader to have the impression that the company “own[s] or lease[s] the [entire] building,” or “at least a few floors.” Wolfpack also inaccurately claimed that only “one employee” worked at the Center, when it knew (or should have known via its independent “research”) that its contracted site-visit reflected a mere moment in time—multiple engineers and researchers work at the Center in rotating shifts, something it would have been impossible for Wolfpack to observe during a singular site visit.

38. Third, the Report falsely insinuates that Datavault is a sham company because its “[l]isted [a]ddresses [a]ppear to [b]e a [b]eauty [s]alon, a [c]oworking [s]pace, and an [i]ncomplete [a]dress.” Report at 5. Instead of acknowledging to its readers that many companies legitimately hold multiple corporate addresses, Wolfpack chose to selectively pick apart certain of Datavault’s disclosed addresses, while ignoring others. Id. Specifically, the Report included a google image of a sign in front of the address for Datavault’s registered agent and executive mailing address in an attempt to convince readers that Datavault operated out of the same building as a “beauty salon.” This is blatantly false. Numerous companies use addresses for their registered agents and executive mailing addresses that are not the same as (or even directly tied to) the company’s operations. Similarly, the implications about Datavault’s disclosed address at a New York-based co-working space ignore that such spaces provide practical and cost-efficient options for companies. Datavault does use a New York City co-working space to conduct business, namely, client meetings and strategy sessions if Datavault personnel are visiting New York City. The Report also incorrectly implied that there was something wrong with Datavault’s operations because it did not “bother listing the principal address on file with the SEC in Beaverton, Oregon which was the headquarters for WiSA, DVLT’s predecessor.” Report at 6. That misrepresentation ignores that, at the time the Report was published, the transition between WiSA and Datavault was ongoing, and the Company was transitioning certain executive offices from Oregon to Philadelphia, PA. This was announced only on October 23, 2025,6 approximately one week before Wolfpack’s hit piece launched.

6 See https://ir.datavaultsite.com/news-events/press-releases/detail/369/datavault-ai-announces-headquarters-relocation-to, last visited November 4, 2025.

12

39. Fourth, the Report made a number of false statements about Datavault’s strategic partnerships. Specifically, Defendants claimed that:

| · | Datavault’s investment from Scilex Holdings is “[i]nsanely [d]ilutive and [a]ppears [t]o [d]epend on a [n]on-[e]xistent [e]ntity,” |

| · | Datavault was “misleading” investors about its partnership with Burke, |

| · | Datavault’s deals with Nature’s Miracles Holdings (“NMHI”) are “complete bullshit.” |

13

40. But none of those statements are true—Defendants seized on a clerical error (and acknowledged as such) in one of Datavault’s filings to claim that the SCLX deal was a “heads you lose, tails you lose” situation. Biconomy.com Exchange, the entity actually involved in the strategic partnership between Datavault and SCLX, is a verified crypto infrastructure firm “that provides global cryptocurrency trading services for a number of digital assets.”7. Indeed, “Bicomony.com Exchange has [recently] unveiled an ambitious strategic roadmap aimed at securing its position as the dominant force in global crypto trading.”8 Defendants’ misleading and false statements served to undermine Datavault’s credibility, impede its strategic business relationships, and put downward pressure on its stock price causing Datavault significant harm.

41. Defendants also claimed that they “cannot comprehend how Burke Products, a small manufacturer of electrical and mechanical components, has now shifted to codeveloping a tokenization system with DVLT. DVLT’s press release seems to imply there’s been an award to Burke Products for these Valor tokens[,] [h]owever, that does not appear to be the case per the government’s contract database.” Datavault’s press release made no such statement and does not support any such implication—the Valor Token program is a pilot under Burke’s veteran benefits contract, and it is not required to be listed in the government’s contract database until it reaches Phase II. Further, Defendants’ claims that Burke is nothing more than a small manufacturer of nuts and bolts with no relationship to Datavault or AI are false and misleading, as Burke is a certified “Tier 1 supplier to Lockheed Martin, Raytheon Technologies” and others, with Department of Defense sole-source eligibility. DVLT’s ADIO® acoustic technology is being integrated into secure communication modules for Burke’s electrical assemblies.9

7 See https://www.biconomy.com/en/about, last visited November 5, 2025.

8 See Biconomy.com Accelerates Toward Global Dominance in Crypto Trading, dated May 8, 20205, available at https://www.cbs42.com/business/press-releases/globenewswire/9447388/biconomy-com-accelerates-toward-global-dominance-in-crypto-trading, last visited November 5, 2025 (emphasis added).

9 See Global Defense Contractor Burke Products Selects Datavault AI for Enhanced National Defense and Aerospace Technologies Contracts - The Globe and Mail, dated July 22, 2025, available at https://www.theglobeandmail.com/investing/markets/stocks/RTX/pressreleases/33548839/global-defense-contractor-burke-products-selects-datavault-ai-for-enhanced-national-defense-and-aerospace-technologies-contracts/, last visited November 5, 2025.

14

42. Also unsurprisingly, the Report’s claims about Datavault’s partnership with NMHI ring hollow. Far from the deals being “total bullshit,” because NMHI purportedly can’t pay the $2,000,000 license as it only has $9,551 in cash, in October 2025, NMHI closed a $15M private placement (after the filing of its Form 10-Q quarterly report), and the first $500,000 milestone payment of the $2,000,000 license fee was already received.

43. Finally, fifth, the Report went beyond its attacks on Datavault as a company and turned its focus on a number of individuals associated with Datavault, including co-founder and CEO Nathanial T. Bradley, co-founder and chief marketing officer Sonia Choi, Vice President of Finance and Chief Accounting Officer of Datavault, and Stanley Mbugua.

44. These personal attacks included misleading statements about Mr. Bradley’s background and history, including falsely asserting that Mr. Bradley purportedly hid his past from Datavault investors and concealed that he was “sanctioned for fraud” during his time at Parallax. Datavault’s SEC filings include all of Mr. Bradley’s prior roles and the 2021 SEC settlement that the Report references was civil, not criminal, and critically, did not involve any admission of wrongdoing, let alone a finding of fraud.

15

45. Perhaps most egregious, the Report implies that Mr. Bradley is involved in a fraudulent and/or criminal scheme with Edward Withrow III—whom the Report refers to as a “convicted felon” and participant in an “elaborate pump-and-dump”—because of a co-investment in a number of patents on behalf of one of Datavault’s shareholders, EOS Technology Holdings Inc. The Report claims that Mr. Withrow “run[s]” a major shareholder of Datavault. That is false. Mr. Withrow is not an officer, director, or control person of Datavault or EOS Technology Holdings, Inc.

46. In a similar vein, and to maximize on guilt-by-association, the Report frequently refers to the fact that Ms. Choi is married to Mr. Bradley, and that, as a result she is also part of “an amazing cast of characters … [described] as top-tier bullshitters.” Report at 1.

47. Taking aim at Datavault’s VP of Finance and CAO, the Report also alleges that Mr. Mbugua “also has a resume that should terrify investors” because he served in prior roles during “shareholder obliteration.” The truth, however, is that Mr. Mbuga joined both Skillz and Presto after those companies had received regulatory inquiries. Mr. Mbuga led successful restatements and compliance overhauls at both firms.

48. Taken together, the above statements and other related statements included in the Report are reasonably understood by readers to mean that Datavault, Bradley, and the other individuals named in the Report are connected to and carrying on a fraudulent scheme designed to defraud investors. Worse still, because of Defendants’ clickwrap agreement and other website embellishments, readers of the Report reasonably understand Defendants to be certifying the truth and accuracy of their statements as factual assertions, discovered through independent research and financial analysis.

16

49. On October 31, 2025, counsel for Plaintiffs wrote Defendants a letter informing them that the Report included false, misleading, and defamatory statements and requesting that Wolfpack Research immediately take down the Report and delete any and all statements about Datavault on Wolfpack’s X page and/or any other social media platform. Counsel for Defendants took over a week to respond, and, as of the date of this filing, has not agreed to issue a retraction. The Report and social media posts containing defamatory statements about Plaintiffs remain publicly available for review.

FIRST CAUSE OF ACTION

Defamation Per Se

(On Behalf of Each Plaintiff Against Each Defendant)

50. Plaintiffs adopt and incorporate each and every one of the allegations set forth in paragraphs 1-41 of this Complaint above, as though fully set forth herein.

51. The statements made by Defendants about Plaintiffs, as identified and described above, are false. To name a few: that Datavault is a “joke”, that Data Vault® is a “wasteland”, that Mr. Bradley was “sanctioned for fraud”, and that the Datavault team are “top-tier bullshitters including a convicted felon”. These false accusations are defamation per se, as they falsely accuse Plaintiffs of criminal wrongdoing and/or association, impute to Plaintiffs an inability to perform or want of integrity in the discharge of their duties, and prejudice Plaintiffs and impute a lack of ability in their trade, profession, or business.

52. Defendants, without privilege and with actual or constructive knowledge of their falsity, publicized these false statements to the investing public, and other persons and entities that Plaintiffs do business with, including in a publicly accessible Report that misleadingly implied its accuracy, and through multiple social media posts.

17

53. Defendants, who claim to have investigated Datavault, knew or should have known that the statements, as stated above, were false; therefore the statements were made negligently or with actual malice.

54. As a direct and proximate result of these false and defamatory statements, Plaintiffs are and continue to suffer damage and disruption to their investor relationships and reputation, and have experienced losses and reduction of business, and a decrease in the value of Datavault’s shares, as well as damages in an amount to be proven at trial. Specifically, Datavault’s stock price continues to experience volatility following the Report’s issuance, having declined approximately 42% since close of trading on October 30, 2025, right before the Report was issued. Additionally, and a number of customers, shareholders, and business partners have expressed concerns to Mr. Bradley about the Report and its impact on the Company.

SECOND CAUSE OF ACTION

Defamation Per Quod

(On Behalf of Each Plaintiff Against Each Defendant)

55. Plaintiffs adopt and incorporate each and every one of the allegations set forth in paragraphs 1-46 of this Complaint above, as though fully set forth herein.

56. The statements made by Defendants are defamatory per se, for the reasons set forth in Count I. Even if all or some of the statements are not found to be defamatory per se, Defendants are liable for defamation per quod because Plaintiffs have suffered specific financial and reputational harms, resulting in concrete adverse consequences on their business. Specifically, Datavault’s stock price has dropped 42% from $2.52 at the close of trading on October 30, 2025 to $1.44 on November 7, 2025.

18

57. Defendants, without privilege and with actual or constructive knowledge of their falsity, publicized these statements to the investing public, and other persons and entities that Plaintiffs do business with.

58. The statements made by the Defendants were made negligently or with actual malice, in that they knew or should have known that such statements were false upon review of facts available in the public sphere, including Datavault’s filings with the SEC.

59. As a direct and proximate result of these false and defamatory statements, Plaintiffs are and continue to suffer damage and disruption to their investor relationships and reputation, and have experienced losses and reduction of business, and a decrease in the value of Datavault’s shares, as well as damages in an amount to be proven at trial. Specifically, a number of investors have sold stock following publication of the Report, and Datavault’s stock has dropped 42% from $2.52 at the close of trading on October 30, 2025 to $1.44 on November 7, 2025.

THIRD CAUSE OF ACTION

FALSE LIGHT

(On Behalf of Plaintiff Bradley Against Each Defendant)

60. Plaintiffs adopt and incorporate each and every one of the allegations set forth in paragraphs 1-51 of this Complaint above, as though fully set forth herein.

61. Mr. Bradley was placed in a false light before the public when Defendants falsely accused him of participating in a scheme to defraud investors, insinuated past and ongoing criminal violations of laws, and/or implications that he, along with the some or all of the other individuals named in the Report, was engaging in improper business practice, and made up a collective “cast of characters” all guilty by association.

62. This false light in which Defendants have portrayed Mr. Bradley would be highly offensive to a reasonable person, since the Report accuses him and his associates of criminal and fraudulent activity, and imputes to him an inability to perform or want of integrity in the discharge of his duties. The misstatements prejudice Mr. Bradley and impute a lack of ability in his trade, profession, or business.

19

63. Defendants did so with actual malice because they had knowledge or recklessly disregarded that the statements were false and placed Mr. Bradley in a false light.

64. As a direct and proximate result of these false and defamatory statements, Mr. Bradley continues to suffer damage and disruption to his investor relationships and reputation, and has experienced financial damage, losses and reduction of business, including a reduction in the value of the company’s stock and loss of customers who sold stock after the Report was published, as well as damages in an amount to be proven at trial.

FOURTH CAUSE OF ACTION

Tortious Interference with Contractual or Business Relations

(On Behalf of Datavault AI, Inc. Against Each Defendant)

65. Datavault adopts and incorporates each and every one of the allegations set forth in paragraphs 1-56 of this Complaint above, as though fully set forth herein.

66. Datavault has protectable business relationships with employees, shareholders, investors, partners (including Burke, SCLX and NMHI), and prospective partners and investors.

67. Defendants, who claim to have conducted extensive investigation into Datavault, are aware of such relationships, but are otherwise strangers to Datavault’s protectable business relationships including with Burke, SCLX, and NMHI.

68. Defendants, as self-described short-sellers, have borrowed and sold Datavault’s stock or a derivative of its stock and therefore do not own a direct or beneficial and/or economic interest in Datavault.

20

69. For their own gain and to Datavault’s detriment, Defendants intentionally interfered with Datavault’s business relationships with its employees, customers, shareholders, investors, and current and prospective business partners by publishing defamatory falsehoods and impugning the integrity of the business, casting doubt on Datavault’s legitimacy and viability, and insinuating a fraudulent scheme involving unethical and criminal behavior.

70. As a result of Defendants’ tortious interference, Datavault has and continues to experience damage, including financial damage and damage to the reputational harm and legitimacy of its partnership, losses and reduction of business with partners and prospective partners, as well as damages in an amount to be proven at trial.

FIFTH CAUSE OF ACTION

Unjust Enrichment

(On Behalf of Datavault AI, Inc. Against Each Defendant)

71. Datavault adopts and incorporates each and every one of the allegations set forth in paragraphs 1-62 of this Complaint above, as though fully set forth herein.

72. On information and belief, in advance of publishing the Report, David (whether acting individually, through Wolfpack Research, or through a separate or affiliated entity) acquired an interest in a financial asset whereby he could obtain a profit in the event that the price of Datavault’s stock was to decrease in price and/or value. Thus, Defendants have intentionally profited from the decline in Datavault’s stock price.

73. Defendants knowingly accepted and retained profits from their short position in Datavault, as well as other financial benefits.

74. These benefits resulted from Defendants’ wanton, malicious, and coordinated attack on Datavault and Mr. Bradley, in a deliberate scheme designed to drive the price of Datavault’s stock downward. Such conduct is inequitable and unconscionable.

21

75. These benefits were received by Defendants to the Plaintiffs’ detriment. Defendants have also benefited to the detriment of Datavault’s shareholders. It would be inequitable for Defendants to be allowed to retain their ill-gotten proceeds, borne of this malicious short-and-distort scheme.

76. As a result, Datavault is entitled to an order requiring Defendants to disgorge the benefits by which they were unjustly enriched.

SIXTH CAUSE OF ACTION

DECLARATORY RELIEF

(On Behalf of Plaintiffs Against Each Defendant)

77. Datavault adopts and incorporates each and every one of the allegations set forth in paragraphs 1-76 of this Complaint above, as though fully set forth herein.

78. Defendants have published, and continue to publish, false, defamatory statements about Plaintiffs, including on their website, in the Report and within Defamatory X Posts.

79. The same day that the report was published, Plaintiffs informed Defendants that the Report included false, misleading, and defamatory statements about Datavault AI, Inc. and Nathaniel T. Bradley, and requested that Wolfpack Research immediately take down the Report and delete any and all statements about Plaintiffs on Wolfpack’s website, X page and/or any other social media platform.

80. As of the date of filing, Defendants refused to issue a retraction and continued to make the Report and social media posts publicly available for review.

81. There is actual and present controversy exists between the parties over Defendants’ ongoing publication of defamatory statements.

22

PRAYER FOR RELIEF

WHEREFORE, Plaintiffs respectfully request that the Court enter judgment in favor of Datavault AI, Inc. and Nathaniel T. Bradley and against Defendants, awarding:

| (a) | Judgment in favor of Plaintiffs; |

| (b) | A narrowly-tailored declaration that: requires Defendants to remove and retract any and all statements in the Report and Defamatory X Posts that are adjudicated by this Court to be Defamatory, and prohibits Defendants from repeating and republishing all such statements; |

| (c) | Compensatory, actual, punitive, special, and/or other damages in an amount to be determined trial greater than $75,000; |

| (d) | Attorneys’ fees and costs; |

| (e) | Pre-and post-judgment interest; and |

| (f) | Such other and further relief as the Court deems just and proper. |

23

Dated: November 9, 2025

| Respectfully Submitted, | |

| PAUL HASTINGS LLP | |

| /s/ Adam M. Reich | |

| ADAM M. REICH | |

| adamreich@paulhastings.com | |

| 71 South Wacker Drive | |

| Suite 4500 | |

| Chicago, IL 60606 | |

| Timothy D. Reynolds (pro hac vice forthcoming) | |

| timothyreynolds@paulhastings.com | |

| 515 South Flower Street | |

| Twenty-Fifth Floor | |

| Los Angeles, California 90071-2228 | |

| 1(213) 683-6000 | |

| Elizabeth A. Parvis (pro hac vice forthcoming) | |

| elizabethparvis@paulhastings.com | |

| 200 Park Avenue | |

| New York, New York 1016 | |

| 1(212) 318-6000 | |

| Counsel for Plaintiffs | |

| Datavault AI, Inc. and Nathaniel Bradley |

24